In the world of trading, precise entry and exit points can make all the difference. The Moving Average Convergence Divergence (MACD) indicator is a powerful tool in the trader’s toolkit, offering insights into potential trade opportunities. In this comprehensive guide, we will delve into how to harness the MACD indicator effectively to extract entry and exit price points with accuracy and confidence.

- Understanding the MACD Indicator

MACD Indicator, Trading Tool, Momentum Oscillator

The MACD indicator is a versatile momentum oscillator that provides insights into the strength and direction of a trend. It is a favorite among traders for its ability to identify potential entry and exit points based on the convergence and divergence of moving averages.

- Selecting the Right MACD Parameters

MACD Parameters, Indicator Settings, Customization

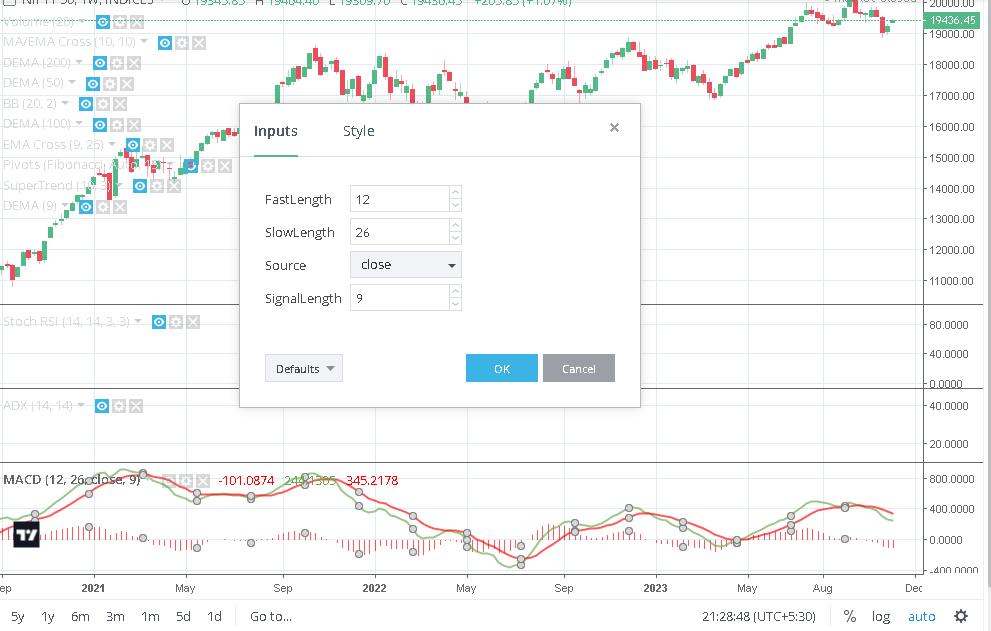

To use the MACD effectively, begin by selecting the right parameters. The signal line, the histogram, and the MACD line make up the three parts of the MACD. You can adjust the settings (typically 12, 26, and 9) to fine-tune the indicator to your trading strategy and timeframe.

- Mastering Entry Points with MACD

Entry Points, Trading Signals, MACD Crossovers

Effective entry points are the foundation of successful trading. Here’s how to use the MACD indicator to identify entry opportunities:

Crossovers: Pay close attention to the MACD line crossing above the signal line (a bullish crossover) or below the signal line (a bearish crossover). These crossovers often signal potential entry points, depending on the direction of the crossover.

Zero Line Cross: When the MACD line crosses above the zero line, it signals a potential entry for a long trade. Conversely, a crossover below the zero line may indicate an entry for a short trade.

Histogram Patterns: The MACD histogram represents the difference between the MACD line and the signal line. Look for histogram bars that expand (bullish) or contract (bearish) to help identify entry points. For example, a series of rising histogram bars can indicate an uptrend.

- Navigating Exit Points with MACD

Exit Points, Profit Booking, MACD Divergence

Effective exit points are essential for locking in profits and managing risk:

Crossover Reversal: To identify exit points, watch for crossovers in the opposite direction of your trade. If you’re in a long trade and the MACD line crosses below the signal line, it may signal an exit point. For a short trade, a MACD line crossover above the signal line could indicate an exit.

Divergence and Convergence: MACD divergence and convergence can be powerful tools for identifying exit points. When the MACD diverges from the price, it may indicate that the trend is weakening, potentially signaling an exit.

Histogram Contraction: Keep an eye on the histogram for signs of contraction, as it can suggest a potential exit point based on a decrease in trend strength.

- Combining MACD with Other Indicators

Indicator Combinations, Trading Strategy, Precision

While the MACD is a robust indicator on its own, combining it with other technical indicators can enhance your trading strategy’s precision. Consider incorporating other indicators or chart patterns that complement MACD signals.

- Practice, Backtesting, and Risk Management

Trading Practice, Backtesting, Risk Management

Before implementing your MACD-based strategies in live trading, practice on historical data, and backtest your approaches. Implement risk management measures, such as setting stop-loss and take-profit levels, to protect your capital.

Conclusion: Unleashing the Power of MACD

Trading Success, MACD Mastery, Effective Trading Strategies

Mastering the MACD indicator is a journey that combines knowledge, practice, and a deep understanding of market dynamics. By selecting the right parameters, fine-tuning your strategies, and applying risk management principles, you can confidently navigate the world of trading and extract entry and exit price points with precision. Happy trading!