In the ever-evolving world of cryptocurrency trading, one strategy stands out for those who seek swift rewards and thrive on market volatility: day trading. Day trading involves buying and selling cryptocurrencies within the same trading day, with the aim of profiting from short-term price fluctuations. In this comprehensive guide, we’ll explore the world of day trading, provide insights into how it works, and present an illustrative example.

The World of Day Trading

Day trading, as the name suggests, revolves around making multiple trades within a single trading day. Traders in this space are like swift chess players, carefully planning each move to capture opportunities within hours or even minutes. The primary focus is on short-term price movements, and traders utilize various tools and strategies to make well-informed decisions.

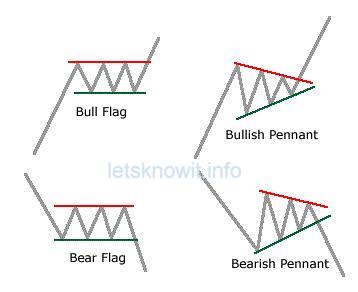

Identifying a Setup: The Bullish Flag: Bullish Setup

Before entering a day trade, day traders often begin by identifying a favorable setup in the market. Let’s consider an example with Bitcoin (BTC). Imagine you’re analyzing the price chart of BTC and spot a “bull flag” pattern. This pattern consists of a strong upward movement (the flagpole) followed by a brief consolidation period (the flag). Bull flags often signify the potential for an upward breakout.

Bull Flag Pattern

With this pattern in mind, you anticipate a short-term bullish move in BTC’s price.

Entering the Trade and Managing Risk: Entering a day trade, Risk management in day trading

With the bullish setup identified, it’s time to enter the trade. You decide to buy 2 BTC at the current price of $56,000 per BTC. As you make this decision, you establish a risk management plan, which is a crucial aspect of day trading. This plan includes setting a stop-loss order at $55,800, ensuring that if the price falls to this level, your position is automatically sold to limit potential losses.

Simultaneously, you set a take-profit order at $57,000, representing your short-term target. This order automatically executes when the price reaches that level.

Monitoring and Exiting the Trade: monitoring the trade, exiting a day trade

With the trade-in progress, you closely watch the price of BTC throughout the day. This monitoring process is essential to ensure that your analysis remains accurate and that market conditions do not unexpectedly change.

Later in the trading day, your analysis proves correct, and the price of BTC breaks out of the flag pattern, reaching your take-profit level of $57,000. Your take-profit order is automatically executed, securing a profit for your trade.

Post-Trade Reflection & Performance Assessment in Day Trading

After the trade, it’s vital to reflect on your performance. As a day trader, this involves a review of what went well and what could have been improved. In this instance, your analysis was on point, and your execution of the trade was effective, resulting in a profit.

Key Aspects of Day Trading

Successful day trading involves several key aspects:

Quick Decision-Making: Day traders must make swift decisions and execute trades efficiently.

Technical Analysis: Technical indicators, chart patterns, and real-time data are essential for identifying entry and exit points.

Risk Management: Risks and Challenges in Day Trading

Effective risk management is crucial for limiting potential losses and preserving capital.

Emotional Control: Day traders must remain disciplined and avoid emotional reactions to price fluctuations.

High Frequency: Day traders often make multiple trades within a single day, capitalizing on short-term market movements.

Risks and Challenges: Day trading presents both opportunities and challenges

Market Volatility: Cryptocurrency markets are renowned for their volatility, exposing day traders to rapid price swings.

Stress and Pressure: The need for quick decision-making and managing multiple trades can be stressful.

Overtrading: Overtrading may lead to potential losses, as some traders may trade excessively.

Learning Curve: Successful day trading requires a deep understanding of technical analysis, market behavior, and risk management.

In conclusion, day trading is a high-risk, high-reward strategy that is not suitable for everyone. It is crucial to practice with a small investment or in a demo account before committing significant capital. Additionally, day traders must continually update their knowledge, adapt to changing market conditions, and approach their trades with discipline and a well-thought-out plan. Happy trading!