In the world of trading, the ability to decipher the perfect entry and exit points is the foundation of success. The Moving Average (MA) indicator is a dynamic tool that traders often employ to gain insights into potential trade opportunities. In this comprehensive guide, we will delve into the art of harnessing the Moving Average indicator effectively to extract entry and exit price points with precision and confidence.

1. The Essence of Moving Averages

Moving Averages, Trading Tools, Price Analysis

Moving Averages are widely used indicators that help traders understand the average price of an asset over a specific time frame. They are fundamental for technical analysis and play a pivotal role in determining entry and exit points.

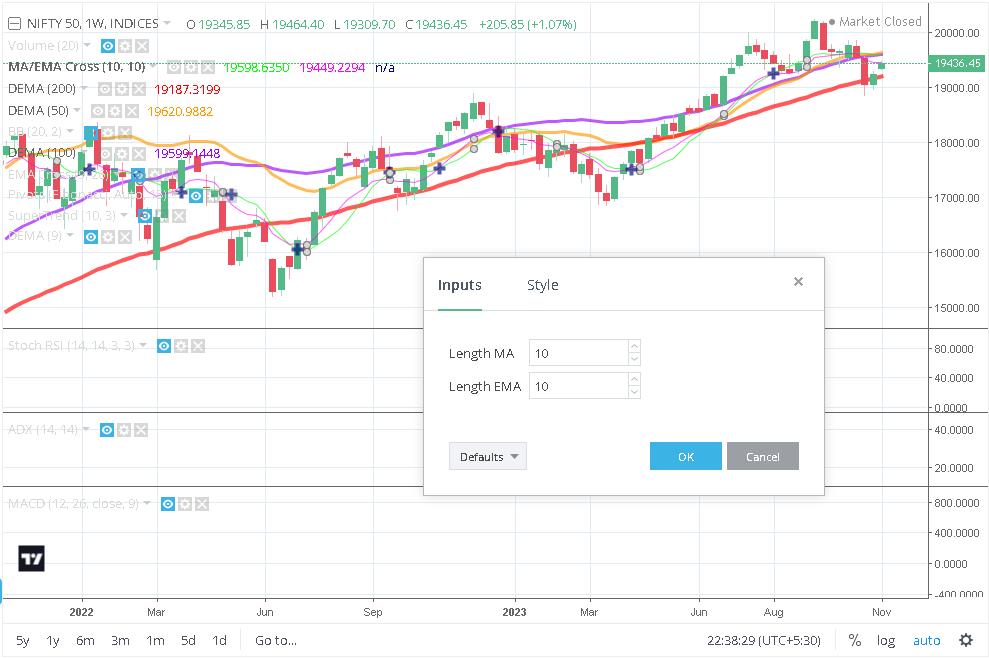

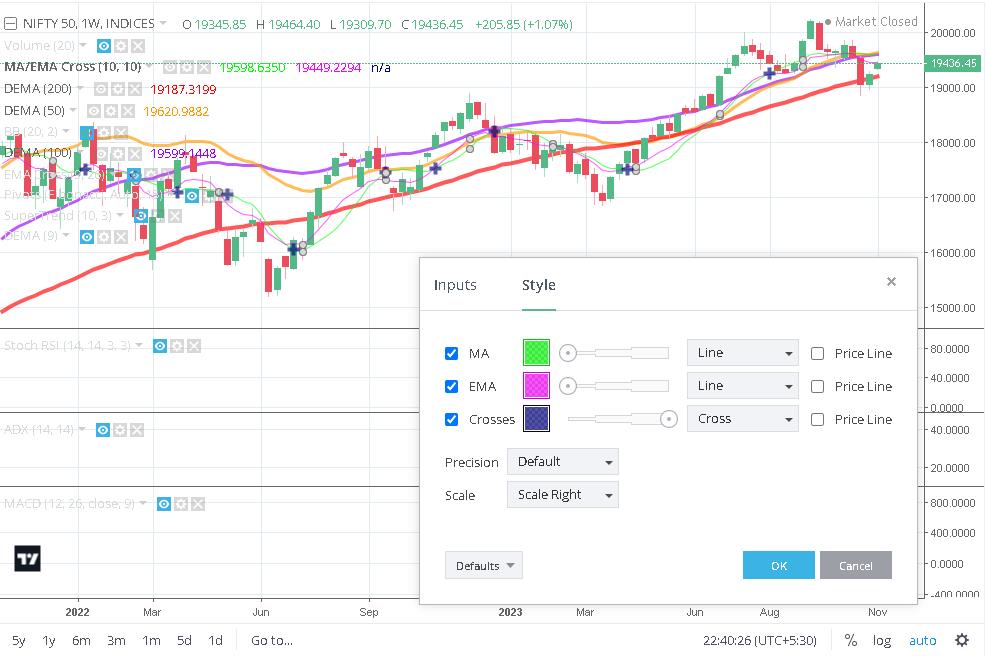

2. Selecting the Right Moving Average Parameters

Moving Average Parameters, Indicator Settings, Customization

To utilize Moving Averages effectively, the first step is choosing the right parameters. There are two primary types of Moving Averages: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). Customizing the settings based on your trading strategy and timeframe is crucial.

3. Mastering Entry Points with Moving Averages

Entry Points, Trading Signals, Moving Average Crossovers

Effective entry points are the backbone of a prosperous trade. Here’s how to use Moving Averages to identify entry opportunities:

- Crossovers: Pay attention to Moving Average crossovers. The “Golden Cross” (short-term MA crossing above the long-term MA) can be a bullish entry signal, suggesting a potential long trade. Conversely, the “Death Cross” (short-term MA crossing below the long-term MA) is a bearish signal that may indicate a short entry.

- Price and Moving Average Alignment: Look for alignment between the asset’s price and the Moving Average. When the price is consistently above the Moving Average, it confirms a bullish trend, potentially signaling entry points for long trades. If the price is consistently below the Moving Average, it suggests a bearish trend and potential entry points for short trades.

- Moving Average Bounce: When the price touches or bounces off the Moving Average, it can serve as a strong entry signal. A bounce off a rising Moving Average may suggest a potential entry for a long trade, while a bounce off a falling Moving Average can signal a short entry.

4. Navigating Exit Points with Moving Averages

Exit Points, Profit Booking, Moving Average Reversals

Having efficient exit strategies is crucial for controlling risk and securing earnings.

- Crossover Reversal: To identify exit points, observe crossovers in the opposite direction of your trade. For instance, if you’re in a long trade and the short-term MA crosses below the long-term MA, it may signal an exit point. For short trades, a short-term MA crossing above the long-term MA can be an exit signal.

- Price and Moving Average Divergence: If the price significantly diverges from the Moving Average, it may signal a potential exit point. For example, if you’re in a long trade and the price moves well above the Moving Average, it may indicate that the trend is becoming overextended, potentially prompting an exit.

- Moving Average Contraction: Keep an eye on the Moving Average for signs of contraction. A significant contraction may suggest a potential exit point due to a decrease in trend strength.

5. Combining Moving Averages for Enhanced Precision

Indicator Combinations, Trading Strategy, Precision

While Moving Averages are powerful on their own, combining them with other technical indicators can enhance the precision of your entry and exit points. Create a well-rounded trading strategy by integrating various technical indicators that complement one another.

6. Practice, Backtesting, and Risk Management

Trading Practice, Backtesting, Risk Management

Before implementing your Moving Average-based strategies in live trading, practice on historical data and backtest your approaches. Use risk management techniques, such as establishing stop-loss and take-profit levels, to safeguard your capital.

Conclusion: Achieving Trading Success with Moving Averages

Trading Success, Moving Average Mastery, Effective Trading Strategies

Mastering the art of extracting entry and exit points with Moving Averages is a journey that combines knowledge, practice, and a profound understanding of market dynamics. By selecting the right parameters, fine-tuning your strategies, and applying risk management principles, you can confidently navigate the world of trading and extract entry and exit price points with precision. Happy trading!

Comments are closed.